capital gains tax news canada

Capital Gains Tax In Canada. For example if you sold an.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/7YDJFYY5XFCBHP2UCALOVAIIFY.jpg)

. In Canada the taxable capital gain must be reported as income on your tax return for the year the asset was sold. When you buy a home you must pay tax on its fair market value at the time of purchase. In Canada 50 of the value of any capital gains is taxable.

When you sold the 100 shares this year you received 50 per share and paid a 50 commission. Since its more than your ACB you have a capital gain. The inclusion rate has varied over time see graph below.

The total amount you received when you sold the shares was 5000. The income is considered 50 of the capital gain. Combined with a 38-per-cent surtax on investment income adopted in 2010 to help fund Barack Obamas health care law the Biden reforms would raise the top tax rate on.

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. On March 11 Finance Canada released draft legislation on the Luxury Tax that was proposed in the 2021 Federal Budget. President Biden wants to raise the capital gains tax that wealthy people pay and use the extra revenue to fund new social spending on children and education.

On June 18 1987 Finance Minister Michael Wilson announced that the rate would increase to 6623. The 50 percent inclusion rate remained in place until the late 1980s. Capital gains tax news canada Sunday March 20 2022 Edit.

Capital Gains Tax In Canada Explained Youtube Pin On Personal Taxes In Canada. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Buy Bitcoin with AMEX.

Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. Subject to parliamentary approval the tax will apply. Canadians pay a 50 tax on all of their.

When investors sell a capital property for more than they paid for it the Canada Revenue Agency CRA applies a tax on. The much more common way is through capital gains taxes. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Congratulations now that you have earned a profit on your investment report it on your tax return because it is a taxable capital gain. As of 2022 it stands at 50.

If you bought a cottage for 200000 and now sell it for 500000 you will receive. Your sale price 3950- your ACB 13002650. Do not include any capital gains or losses in your business or property income even if you.

The inclusion rate is the percentage of your gains that are subject to tax. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than.

You owe capital gains taxes on the profit that you make whenever you sell an investment asset or.

2022 Capital Gains Tax Rates In Europe Tax Foundation

Raising The Capital Gains Tax Would Soak More Than Just The Rich New Analysis Suggests Financial Post

Real Estate Capital Gains Tax Rates In 2021 2022

Know The Strategies When It Comes To Taxes On Options Ticker Tape

Selling Stock How Capital Gains Are Taxed The Motley Fool

Cra Principal Residence Exemption Crackdown What You Need To Know Financial Post

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

6 3 Explanation And Interpretation Of Article Vi Under U S Law Canada U S Tax Treaty Tax Professionals Member Article By The Accounting And Tax

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Singh Pledges To Crack Down On House Flippers By Hiking Taxable Amount Of Capital Gains National Globalnews Ca

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Ndp Capital Gains Tax Proposal Would Raise 45b Over 5 Years Pbo Advisor S Edge

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Capital Gains 101 How To Calculate Transactions In Foreign Currency

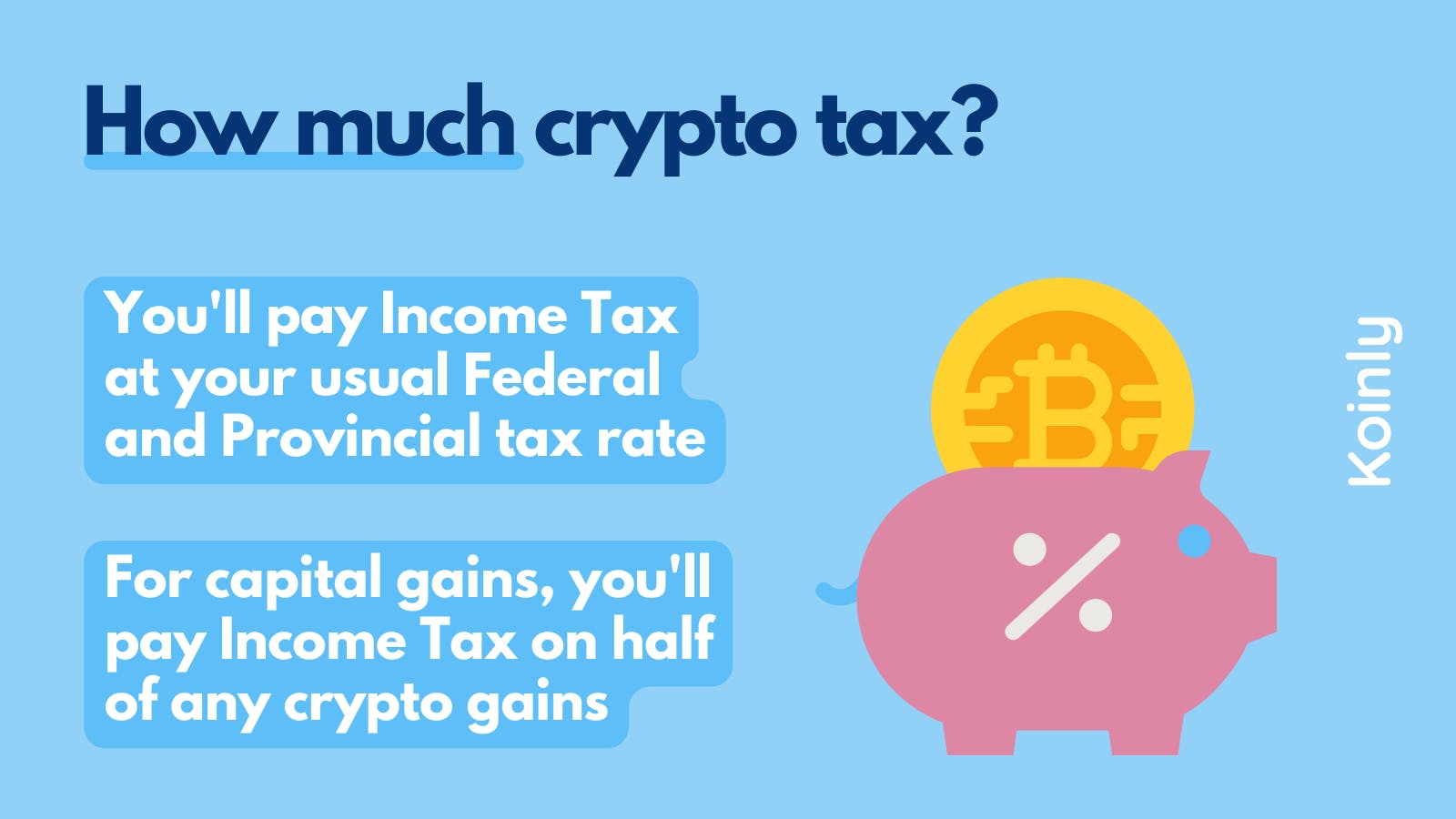

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax Hike Would Be Disastrous For Economic Recovery Fraser Institute